Business Acquisition Brokers

Unique Access To

Confidential Opportunities

Acquisition Intelligence

Acquisitions gain a strategic competitive edge in the market, but buying a business requires intelligence for the right targets, synergistic fit, timing, and the best price and value.

Utilizing our extensive resources and cutting-edge technology in data information, Pavilion’s team gives you an ‘unfair advantage’ to help you reach your acquisition goals.

Flying below the radar is our strategic advantage. We are actively engaged in researching sectors and niche vertical markets that effectively connect businesses that fit your profile and criteria.

“Procurement generally involves making an opportune buying decision under conditions of scarcity, necessity or difficulty.”

Pavilion executes your acquisition strategy by providing insight into market conditions, identifying and screening acquisition candidates, facilitating communication, analyzing data and helping you compose a fair offer that will be accepted, all while maintaining your privacy and confidentiality.

Is The Right Team

In Your Corner?

Pavilion’s demographic profiling system has a dedicated team of researchers who engage in industry-specific communication to identify the right organizations and achieve the best fit.

Acquisition Intelligence allows the Pavilion team to precisely identify strategic sellers from a range of selection criteria, including:

- Specific business sectors

- Revenue size and employees

- Country, location and address

- Cash flow and EBITDA profile

- Other criteria as required

Experience Matters

We can qualify the right targets, synergistic fit and price for maximum value.

Pavilion’s experience, negotiating skills, transaction execution, and history of delivering successful deals has resulted in satisfied clients who have proven Pavilion’s track record.

Free Complimentary Report

DO YOU HAVE ACQUISITION INTELLIGENCE?

Explains the importance of deal flow, timing and market intelligence for acquisitions for buyers wanting to buy a business.

“Pavilion’s defined demographic profiling adds big intelligence to strategic targeting.”

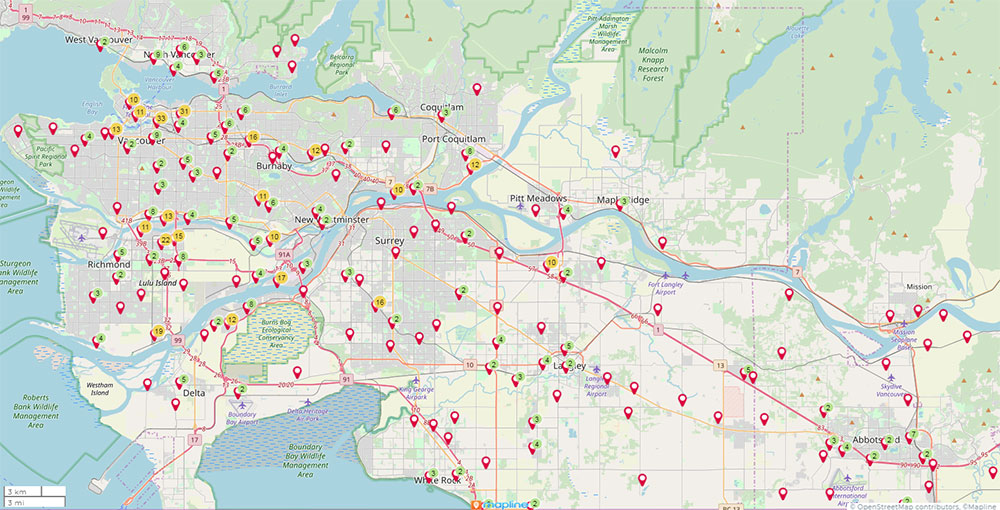

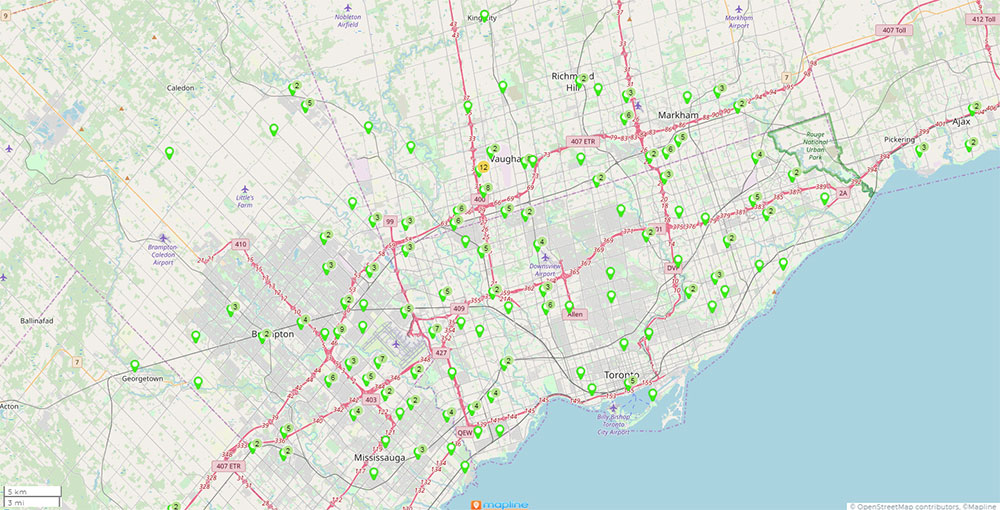

The Pavilion advantage produces customized region, industry and sector heat maps to identify and match your specific criteria and target goals. You gain clearer insight for decision-making to achieve your optimum results.

Sample of Greater Vancouver region heat map of defined target profile for the Food sector within Clients specified criteria.

Sample of Toronto region heat map of defined target profile for the HVAC sector within Clients specified criteria.

Join Our Exclusive

Data Room

Connect to our private exposition of M&A Opportunities. Fill out the Buyer’s Registration to get started. Be first on the list of prime business opportunities for sale. We’ll match your criteria to exclusive listings.

Be First On The List Of Newly Listed Businesses For Sale

Fill out the Buyer’s Registration to get started. Be first on the list of prime business opportunities for sale. We’ll match your criteria to exclusive listings.

Buy A Business

With Intelligence

Achieve Acquisition Intelligence For Buying A Business

Gain a competitive edge in making opportune buying decisions. Create strategic growth and market advantages. Begin your future here.

Watch Video